Cybersecurity Isn’t a Job for Bank Examiners Analysis Report

5W1H Analysis

Who

Key individuals and organisations involved in this context include financial regulators, federal oversight bodies, and bank examiners across jurisdictions. Stakeholders also involve cybersecurity experts and financial institutions targeted in cyber attacks.

What

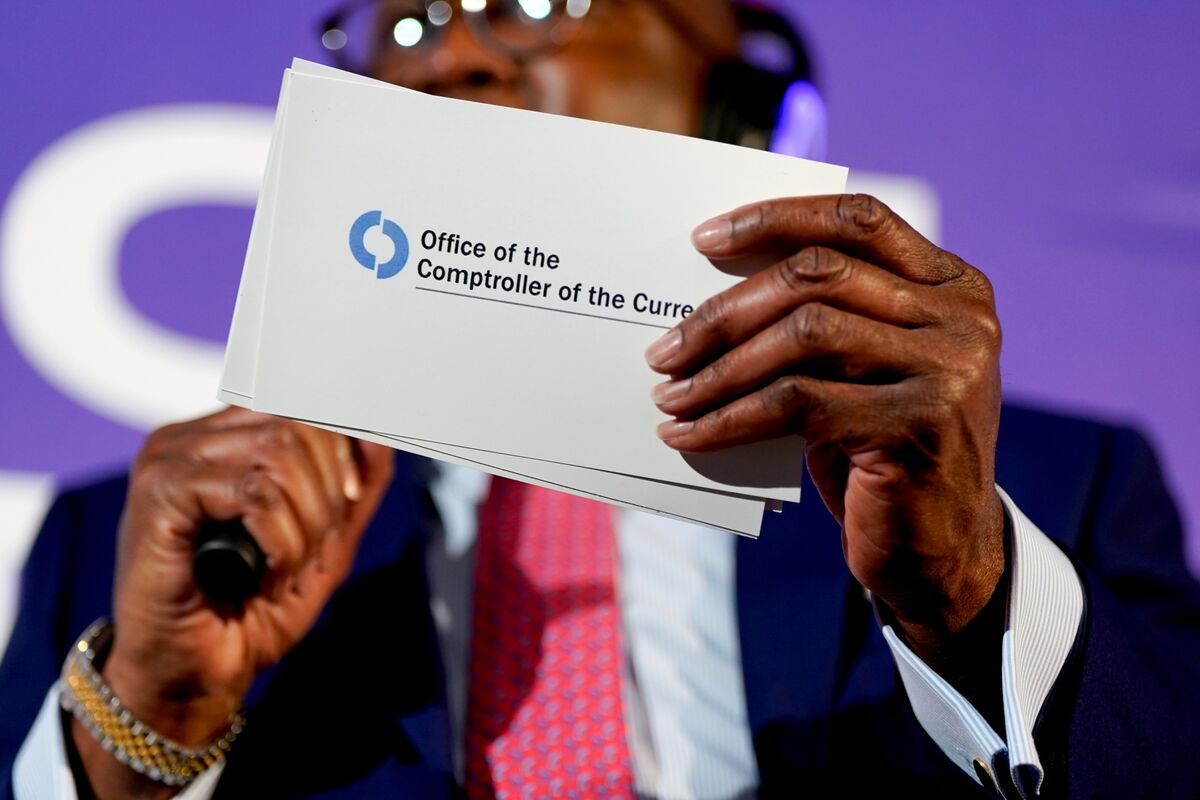

A major cybersecurity breach affected a key financial regulator. This incident highlights the inadequacy of current federal oversight mechanisms and expertise in handling the cybersecurity requirements of financial companies.

When

The incident occurred recently but was reported on 11th June 2025. The inadequacy in response suggests ongoing oversight challenges prior to this specific breach.

Where

This event has significant implications across financial sectors mostly in developed markets where regulatory bodies oversee numerous financial institutions.

Why

The breach underscores a pressing need to enhance cybersecurity measures within federal financial oversight. Existing frameworks primarily focused on traditional financial metrics are ill-equipped for sophisticated cyber threats.

How

The breach was facilitated by outdated oversight processes that failed to integrate advanced cybersecurity protocols effectively, thereby exposing vulnerabilities within the regulatory environment.

News Summary

A recent hack targeting a significant financial regulator has drawn attention to the limitations of current federal oversight concerning cybersecurity in the banking sector. The incident reveals significant gaps in how bank examiners manage modern cyber threats, establishing a crucial need for an upgrade to federal oversight mechanisms.

6-Month Context Analysis

Over the past six months, similar cybersecurity incidents in the financial sector have underscored systemic vulnerabilities. High-profile breaches have affected institutions globally, prompting some regions to begin incorporating cybersecurity specialists into their regulatory frameworks, although progress has been uneven.

Future Trend Analysis

Emerging Trends

Increased integration of cybersecurity expertise within regulatory bodies is anticipated. We expect more stakeholders to emphasize regulatory-driven cybersecurity reforms to protect financial institutions effectively.

12-Month Outlook

We predict a concerted shift towards hiring cybersecurity professionals within financial regulators, coupled with the development of specific cyber risk frameworks. These changes aim to bolster resilience against sophisticated cyber attacks in the banking sector.

Key Indicators to Monitor

- Hiring patterns of cybersecurity experts by regulatory bodies - Legislative developments aimed at strengthening cyber regulations - Frequency and severity of breaches within critical financial infrastructures

Scenario Analysis

Best Case Scenario

Regulatory bodies successfully integrate cybersecurity professionals, reducing cyber attack frequency and severity, thereby protecting economic stability.

Most Likely Scenario

Progressive improvement occurs with incremental updates to regulatory frameworks as new incidents highlight vulnerabilities, driving adaptive reforms.

Worst Case Scenario

Without significant reform, continued breaches lead to financial instability, with increased costs for financial institutions and potential destabilisation of smaller players.

Strategic Implications

Regulators should prioritise incorporating cybersecurity expertise and updating frameworks to address modern threats. Financial institutions might consider proactive collaboration with regulators to enhance mutual resilience. Continued investment in cybersecurity technology and training is critical across all financial sectors.

Key Takeaways

- Regulatory bodies face a crucial need to integrate cybersecurity expertise, affecting oversight dynamics in developed markets (Who/Where).

- Recent incidents highlight inadequacies in current regulatory approaches to cybersecurity threats (What).

- There is a growing trend towards regulatory enhancement to mitigate cyber risks (Why).

- Future developments will likely focus on specialised cyber risk frameworks within financial oversight bodies (How).

- Monitoring shifts in regulatory hiring and legislation is vital for adapting to emerging cyber threats (Where/Why).

Discussion